野村ホールディングス定時株主総会の株主提案がぶっ飛んでいると話題に

157 名前:名無しさん@お金いっぱい。[sage] 投稿日:2012/06/02(土) 02:00:46.73 ID:qe+oZpqK0

野村の英語版あったわ

[English Translation] NOMURA

Notice of Convocation of the 108th Annual Meeting of Shareholders

Nomura Holdings, Inc.

http://www.nomuraholdings.com/investor/shm/2012/data/report108.pdf

Shareholder Proposals (Proposals 2 through 19)

Shareholder Proposals 2 through 19 have been submitted by one shareholder. This shareholder has submitted 100 proposals such as to change of the Company’s trade name to “Yasai Holdings” [In English, literally: “Vegetable Holdings”]; however, only Proposals 2 through 19 satisfy the requirements to be submitted to a meeting of the shareholders.

The details of and reasons for these proposals are provided below and, except for the omission of individual’s name are set forth below in the same order as, and verbatim from the original text.

Proposal 2: Amendment to the Articles of Incorporation (Regarding the pronunciation of the trade name in English and registration procedures)

Proposal 3:

Amendment to the Articles of Incorporation (Regarding the short title of the trade name in the domestic market and the introductory remark to be used by sales persons)

Details of Proposal:

The short title of the Company’s name should be written as “YHD” and pronounced as “wai-eichi-dei” in the Japanese market. It should be stipulated in the Articles of Incorporation that a sales person must always state that “please remember as vegetables, healthy, diet” as an introductory remark when he/she introduces himself/herself to another person for the first time.

Reasons for Proposal:

This is proposed in pursuit of “corporate-wide mindset reform.”

The current trade name of the Company is too long and significantly detrimental to operating efficiency. With 17 morae, one can compose a haiku. If the Company should become a company under the control of the Bank of Tokyo-Mitsubishi UFJ, the name of Yasai Securities could become Mitsubishi UFJ Morgan Stanley Yasai Securities. I am already worried about this possibility.

However, with the proposed change, the Company can save personnel expenses by an amount that is equivalent to 1,000 mandays per year for the time being.

Proposal 4: Amendment to the Articles of Incorporation (Regarding limitations on Compensation Committee determined executive compensation)

Proposal 5: Amendment to the Articles of Incorporation (Regarding limit on the ratio of personnel expense to income and giving three banzai cheers)

Details of Proposal:

It should be stipulated in the Articles of Incorporation that the ratio of personnel expense to income of the Company shall be restricted to 20% or less and the practice of giving three banzai cheers at the shareholders meeting shall be abolished.

Reasons for Proposal:

This is proposed for the purpose of “making compensation and performance evaluation fair.”

According to the principle of “pay for performance,” negative performance should be rewarded with negative compensation.

Well, the current situation of the Company in which personnel expenses are rising while the financial performance is declining ought to be given the evaluation that “the internal control system of the Company has collapsed” for the time being.

By ensuring appropriate control of compensation versus income, this weird corporate entity will be able to show that it is still breathing and that it is willing to hold its own just before being driven to mental distraction and to regain market confidence. In the first place, with a ratio of personnel expense to income hovering over 40%, it is impossible to hope for high dividends to shareholders.

In addition, I hope that the Company will refrain from the usual practice of giving three banzai cheers as the venue is small and there are many shareholders with strong armpit odor.

Proposal 6: Amendment to the Articles of Incorporation (Regarding the limitation of liabilities of directors)

Details of Proposal:

Chapter V, Article 33 of the Articles of Incorporation that provides for the limitation of liabilities of directors should be deleted.

Reasons for Proposal:

This is proposed for the purpose of “making compensation and performance evaluation fair.”

Even after the Nomura Shock caused by the dilution of value per share due to two major public stock offerings within one year,which was also called “violation of the unwritten law,” none of the directors of the Company clearly took responsibility for such a result.

A position such as “Chief Irresponsible Executive Officer” is unnecessary.

Shareholders are stakeholders of the Company; however, the irresponsible corporate culture of the Company that nobody takes any responsibility for the clear damage to them is one of the causes of the current decline in stock price. As the Company is currently in a crisis, negligence of the directors means a bankruptcy. While in office, directors should cut off their own path of retreat and be ready for personal bankruptcy at any time.

Proposal 7: Amendment to the Articles of Incorporation (Regarding addition of purpose to the Articles of Incorporation)

Proposal 8: Amendment to the Articles of Incorporation (Regarding stock option plans as executive compensation)

Details of Proposal:

It should be set forth in the Articles of Incorporation that plans that grant stock acquisition rights to directors as part of their compensation shall be abolished.

Reasons for Proposal:

What is pleasure?

Isn’t it to receive for 1 yen a receivable with an exchange value of just above 100 yen? The Company continues to have plans

that grant directors rights to buy a new share at 1 yen as part of directors’ compensation. These plans should immediately be abolished as they only have the effect of bringing the stock price closer to 1 yen. Directors would not desire any increase in the stock price until they can sell the new shares they bought. If the Company intends to “share risks with shareholders,” directors should “be given the obligation to buy shares at the price of 5,000 yen per share.”

Proposal 9: Amendment to the Articles of Incorporation (Regarding method of capital increase)

Details of Proposal:

It should be set forth in the Articles of Incorporation that in future, capital increase shall be carried out only by rights issue and not by public stock offering and that any decision on a public stock offering shall be subject to a resolution of the shareholders meeting.

Reasons for Proposal:

This is proposed for the protection of shareholders’ rights.

The two previous capital increases through public stock offerings were carried out by lottery and existing general shareholders were not even allowed to resort to averaging. As a result, general shareholders, although they are important stakeholders, became onesided victims of dilution of value per share.

As currently evaluated, such capital increases through public stock offering made no sense other than dilution of value per share, although they were useful as a funding source for directors’ bonuses. It is clear that they had no positive implications whatsoever to the shareholders. In future, any capital increase through public stock offering should be subject to a resolution of the shareholders meeting in order not to let the board of directors run wild.

Proposal 10: Amendment to the Articles of Incorporation (Regarding information disclosure)

Details of Proposal:

It should be stipulated in the Articles of Incorporation that the details of the scenario for the shareholders meeting and rehearsals by employee shareholders shall be disclosed at least 8 weeks before the date of the shareholders meeting.

Reasons for Proposal:

It is clear that the Company is hostile to general shareholders and has an intention to thoroughly control them although the shareholders should be the main body of the shareholders meeting and I wonder if the Company should do something like that in the first place. Doesn’t this mean management misappropriates the Company for its own use? I think the idea that “the superior should not be allowed to make a judgment because he/she would make a mistake” is bad. If the Company insists on doing it, I want the Company to clearly write, we’re going with this scenario, in the convocation notice to shareholders.

Proposal 11: Amendment to the Articles of Incorporation (Regarding restriction on investee)

Details of Proposal:

It should be stipulated in the Articles of Incorporation that the Company is prohibited from lending to or investing in Tokyo Electric Power Company and Kansai Electric Power Co., Inc.

Reasons for Proposal:

By putting on a pretense of agreeing with Hashism in this way, the Company could impress the world that it is a serious company, and thereby earn loads in commercial transactions. Even if the Company opposes and rejects this proposal, this proposal may be publicly broadcasted as an example of proposals that support Hashism. I think I also have about 300 units of shares in Mizuho Financial Group, but they are currently loaned to a securities company. Therefore, I make this proposal only to you this year.

Proposal 12: Amendment to the Articles of Incorporation (Regarding overhaul of basic daily movements)

Details of Proposal:

It should be stipulated in the Articles of Incorporation that all toilets within the Company’s offices shall be Japanese-style toilets, thereby toughening the legs and loins and hunkering down on a daily basis, aiming at achieving 4-digit stock prices.

Reasons for Proposal:

The Company is on the verge of bankruptcy. In other words, it is the time to hunker down. The Company cannot avoid bankruptcy if it merely adopts a spiritual approach such as encouraging sales persons to speak in a loud voice, but the Company can surely avoid failure if they straddle over a Japanese-style toilet every day and strengthen their lower body. If it cannot, it can only be accepted as a bad luck.

Proposal 13: Amendment to the Articles of Incorporation (Regarding the name of the director position)

Details of Proposal:

It should be stipulated in the Articles of Incorporation that the director position shall internally be called “crystal role” and the Representative Director and President shall be called the Representative Crystal Role and President.

Reasons for Proposal:

The word “director” sounds formal. In addition, I noticed during the shareholders meeting last year that the board of directors does not appear at all to be directing the performance of the subsidiaries under its control. If it is reported that tomato growing is not profitable, the board of directors should discuss “why it is not profitable” and “how to make it profitable.” Just settling with “it is not very profitable” with no further deliberation is not the way the board of directors should be conducted.

Therefore, it suffices to call the director position by a slipshod name.

Proposal 14: Amendment to the Articles of Incorporation (Regarding outsourcing of account opening businesses)

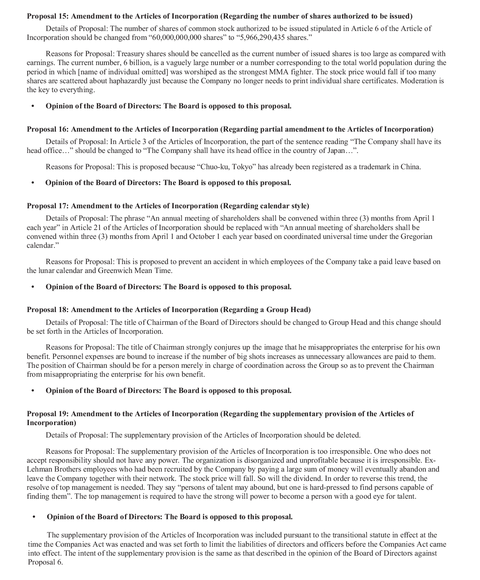

Proposal 15: Amendment to the Articles of Incorporation (Regarding the number of shares authorized to be issued)

Details of Proposal:

The number of shares of common stock authorized to be issued stipulated in Article 6 of the Article of Incorporation should be changed from “60,000,000,000 shares” to “5,966,290,435 shares.”

Reasons for Proposal:

Treasury shares should be cancelled as the current number of issued shares is too large as compared with earnings. The current number, 6 billion, is a vaguely large number or a number corresponding to the total world population during the period in which [name of individual omitted] was worshiped as the strongest MMA fighter. The stock price would fall if too many shares are scattered about haphazardly just because the Company no longer needs to print individual share certificates. Moderation is the key to everything.

Proposal 16: Amendment to the Articles of Incorporation (Regarding partial amendment to the Articles of Incorporation)

Details of Proposal:

In Article 3 of the Articles of Incorporation, the part of the sentence reading “The Company shall have its head office…” should be changed to “The Company shall have its head office in the country of Japan…”.

Reasons for Proposal:

This is proposed because “Chuo-ku, Tokyo” has already been registered as a trademark in China.

Proposal 17: Amendment to the Articles of Incorporation (Regarding calendar style)

Details of Proposal:

The phrase “An annual meeting of shareholders shall be convened within three (3) months from April 1 each year” in Article 21 of the Articles of Incorporation should be replaced with “An annual meeting of shareholders shall be convened within three (3) months from April 1 and October 1 each year based on coordinated universal time under the Gregorian calendar.”

Reasons for Proposal:

This is proposed to prevent an accident in which employees of the Company take a paid leave based on the lunar calendar and Greenwich Mean Time.

Proposal 18: Amendment to the Articles of Incorporation (Regarding a Group Head)

Details of Proposal:

The title of Chairman of the Board of Directors should be changed to Group Head and this change should be set forth in the Articles of Incorporation.

Reasons for Proposal:

The title of Chairman strongly conjures up the image that he misappropriates the enterprise for his own benefit. Personnel expenses are bound to increase if the number of big shots increases as unnecessary allowances are paid to them.

The position of Chairman should be for a person merely in

Proposal 19: Amendment to the Articles of Incorporation (Regarding the supplementary provision of the Articles of Incorporation)

Details of Proposal:

The supplementary provision of the Articles of Incorporation should be deleted.

Reasons for Proposal:

The supplementary provision of the Articles of Incorporation is too irresponsible. One who does not accept responsibility should not have any power. The organization is disorganized and unprofitable because it is irresponsible. Ex-Lehman Brothers employees who had been recruited by the Company by paying a large sum of money will eventually abandon and leave the Company together with their network. The stock price will fall. So will the dividend. In order to reverse this trend, the resolve of top management is needed. They say “persons of talent may abound, but one is hard-pressed to find persons capable of finding them”. The top management is required to have the strong will power to become a person with a good eye for talent.

159 名前:名無しさん@お金いっぱい。[sage] 投稿日:2012/06/02(土) 02:05:47.70 ID:g1Qq8OWe0

>>157

おもしれえw

代表クリスタル役も訳されてるw

ダジャレ感はなくなってるけど

160 名前:名無しさん@お金いっぱい。[sage] 投稿日:2012/06/02(土) 02:06:20.53 ID:tsO+Fy/V0

>>157

英訳版はたぶん野村が発注して作ったってことだよね、

これの検品とかつれーしごとだね。

402 名前:名無しさん@お金いっぱい。[sage] 投稿日:2012/06/02(土) 08:07:45.44 ID:4KdgKuwa0

>>157

英語であの面白さを伝えるの大変だよね

いつものことなのだろうか?本日付の野村ホールディングスの招集通知(株主提案)、一見の価値あり。また、一言一句、丁寧に英訳されてるとこもスゴイ。日本のキャピマに携わるものとして、かなり恥ずかしいです。

— tsuzukkeさん (@tsuzukke) 6月 1, 2012野村、改め野菜ホールディングス ちゃんと英訳版も作ったのか。あの独特の株主提案の文章を、きっちり翻訳するって、なんて難儀な。 翻訳者さんもお疲れさま…。

— なみすけさん (@namisuketea) 6月 1, 2012いかん、英語だと更に味わい深くてまた吹いてしまった。不謹慎でごめんなさい。。“@Nobuyuki_Kawai: 野村HDの例の招集通知、英訳版もちらっと見ましたが、英訳された方のご苦労が本当にしのばれます。。。nomuraholdings.com/investor/shm/2…”

— shinjさん (@shinjitwt) 6月 1, 2012英語にしちゃったら野村→野菜のギャグがわからないじゃん。ちゃんと説明してるのかな?

— 朧月さん (@hazy_mn) 6月 1, 2012全部読んだ。確かに勉強になる。しかし、Proposal 12の和式便所のくだりは英文でも笑ってしまう。不謹慎ながら。 RT @motohirosakaki: 野村HDの英語版招集通知を見つけました。bit.ly/JEH57P 英語の勉強に最適です。

— yangさん (@yang_baggio) 6月 1, 2012公募増資で3回もインサイダー情報流して大丈夫ですか? RT @fu4: 野村證券は英語で、 NO MORE Securitiesと聞こえてしまったことがあり、彼の地の人から爆笑をいただいたことがあります・・・・

— EIJI PAGEさん (@EIJI_PAGE) 6月 2, 2012

コメント